| Closing Disclosure - Purchase > Purchase - Page 2 > G. Initial Escrow Payment at Closing |

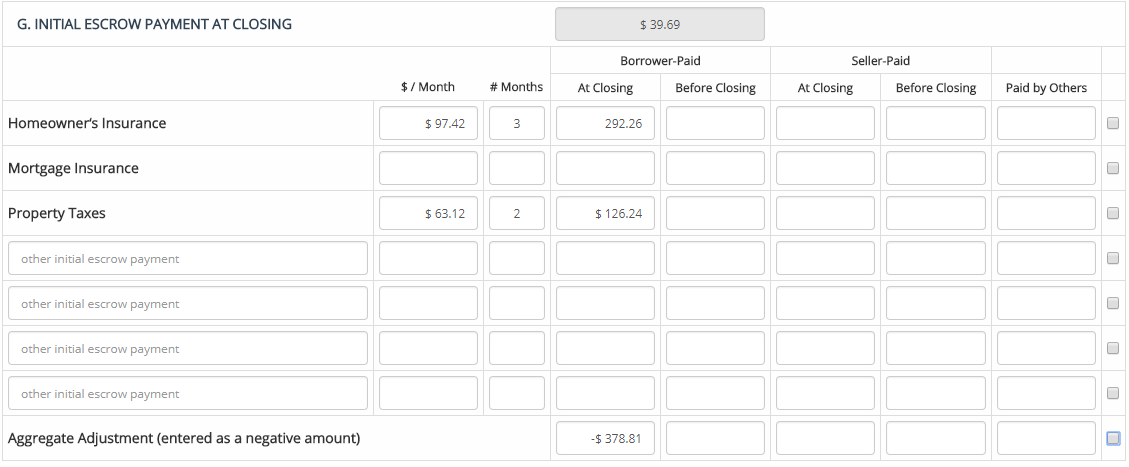

Initial Escrow Payment at Closing includes items that the consumer will be expected to place into a reserve or escrow account at consummation to be applied to recurring periodic payments. Initial Escrow Payment at Closing includes

Homeowner’s Insurance - Enter the escrowed per month for homeowner's insurance, the number of months collected at consummation, and the total amount paid.

Mortgage Insurance - Enter the escrowed per month for mortgage insurance, the number of months collected at consummation, and the total amount paid.

Property Taxes - Enter the escrowed per month for property taxes, the number of months collected at consummation, and the total amount paid.

Aggregate Adjustment - Enter any aggregate adjustment as determined under RESPA 1024.17 escrow calculating. Enter as negative value.

Refer Regulation X (1024.17(d)(2); Comment 38(g)(3)-2) for the calculation of the Aggregate Adjustment.

Refer Regulation X (1024.17(d)(2); Comment 38(g)(3)-2) for the calculation of the Aggregate Adjustment.

|

Property Taxes paid during different time periods can be disclosed as separate items. For example, general property taxes assessed for January 1 to December 31 and property taxes to fund schools for November 1 to October 31 can be disclosed as separate items.

|